Risk registers are one of the most established artefacts in enterprise risk management. They are reviewed by executives, scrutinised by boards, and frequently referenced as evidence that risk is being identified, assessed, and managed. Yet in many organisations, risk registers tell a reassuring story rather than an accurate one.

This is not because people are dishonest or incompetent. It is because the process by which risks are identified, scored, and reported quietly reshapes reality. Over time, the register becomes a reflection of what is acceptable to report rather than what is genuinely threatening to the organisation.

This article examines how risk registers drift away from truth, why this happens even in mature organisations, and what leaders should look for when the register appears calm.

The Sanitisation Effect

Risk registers rarely lie outright. They soften. As risks move from operational teams to senior management, language becomes more measured, scores are moderated, and uncertainty is reduced to fit predefined scales.

Operational teams often start with real concerns. They see control weaknesses, resource constraints, and near-misses that feel material. However, as risks pass through review cycles, they are reframed to align with appetite, tolerance, and precedent. Extreme scores are challenged. Reputational risks are generalised. Strategic risks become narratives rather than exposures.

The result is a register that feels controlled, balanced, and defensible, but one that no longer reflects how fragile certain parts of the organisation actually are.

Explore Our: Enterprise Risk Management (ERM) Training Courses

Scoring systems create false precision

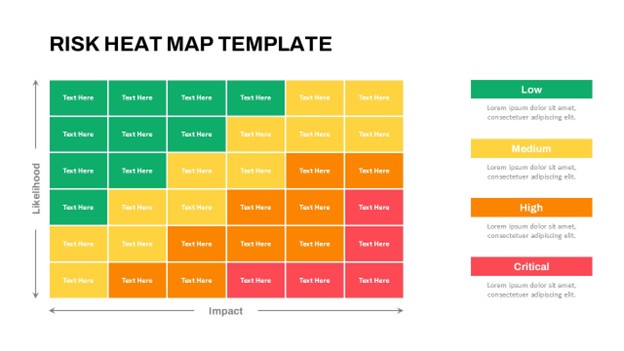

Most risk registers rely on scoring models that assign numerical values to likelihood and impact. These models create an appearance of objectivity, but they are highly sensitive to interpretation.

Two people assessing the same risk may legitimately arrive at different scores based on experience, incentives, or perceived tolerance for escalation. Over time, scoring converges not around truth, but around what is acceptable. High scores attract attention, challenge, and scrutiny. Moderate scores pass more easily through governance forums.

This creates a behavioural incentive to score risks into the middle of the matrix. Extreme risks exist, but they are rarely recorded as such unless they have already materialised.

Aggregation hides concentration

Boards and executives rarely review raw risk registers. They review aggregated outputs: heat maps, top ten risks, trend arrows, and summaries. Aggregation simplifies oversight, but it also hides concentration.

Multiple related risks may be spread across categories, owners, or business units, each appearing manageable in isolation. When viewed together, they represent a systemic exposure. The register does not reveal this because it was not designed to surface interaction or dependency.

This is particularly dangerous in areas such as technology, third-party reliance, transformation initiatives, and organisational change, where individual risks compound rapidly.

Known risks become normalised

One of the most misleading aspects of risk registers is their treatment of persistent risks. Risks that remain on the register year after year without material change are often interpreted as being under control.

In reality, persistence may indicate the opposite. It may signal issues that are structurally difficult to resolve, commercially inconvenient, or politically sensitive. Over time, their continued presence becomes normalised. They are accepted as part of the operating environment rather than challenged as unacceptable exposures.

The register records their existence, but governance fails to address their root cause.

Risk registers favour the visible over the uncomfortable

Risk identification processes are biased toward what is already understood. Compliance risks, regulatory obligations, and established operational issues are well represented because they are visible, familiar, and auditable.

Emerging risks, behavioural risks, and strategic blind spots are harder to articulate and easier to contest. They often rely on judgment rather than evidence, making them more vulnerable to challenge during review.

As a result, the register becomes backward-looking. It captures what the organisation already knows how to manage, while the most dangerous risks remain poorly defined or absent entirely.

The reassurance trap for boards

From a board perspective, a well-maintained risk register can be deeply reassuring. Risks are documented. Owners are assigned. Controls are listed. Residual ratings are within appetite.

The danger is that reassurance replaces inquiry. Boards may stop asking how confident management really is, where uncertainty is greatest, or which risks are most uncomfortable to discuss. The absence of volatility in the register is interpreted as stability, rather than as a potential warning sign.

A risk register that never surprises is rarely telling the full truth.

Reframing the role of the risk register

The purpose of a risk register is not to provide comfort. It is to surface uncertainty, expose weakness, and provoke challenge. When it becomes a polished reporting tool, it loses its value as a governance instrument.

For senior leaders, the question should not be whether the register looks reasonable, but what is missing from it. Which risks are difficult to score. Which issues generate debate. Which exposures have remained unresolved for too long.

For GRC leaders, credibility comes from resisting the pull toward sanitisation. It comes from protecting space for discomfort, dissent, and uncertainty within formal reporting structures.

A risk register that tells an unsettling story is far more valuable than one that reassures. In governance, clarity is earned not through neatness, but through honesty. Explore Our: ERM Training Courses